The holiday season is approaching and with it, endless excuses to buy Christmas gifts, new home decorations, and new clothes. Sometimes purchases can be related to the desire to fill voids or the difficulty in facing certain emotional needs. This compulsive way of buying can put a strain on your pocketbook. That’s why we’re going to talk about compulsive purchases and tips to maintain financial security.

Photo by Tamanna Rumee on Unsplash

What is Compulsive Buying?

Compulsive buying is characterized by persistent purchases that a person experiences as the irresistible and intrusive desire to acquire new items, leading to problems in their personal, social, and work environment, as well as in their finances.

In some cases, the episodes are triggered by negative moods (depression, anxiety) while in others by positive moods (euphoria, mania).

The age of onset is usually between 18 and 30 years, being more common among women (80%). The items purchased by male compulsive buyers are usually related to leisure and independence, while female compulsive buyers prefer objects related to appearance.

Studies indicate the prevalence in the general population ranges between 1% and 11.3% (depending on the instruments used for diagnosis). In 2006 the prevalence of compulsive buying in the United States was 5.8%, in 2010 Germany registered a prevalence of 7% and by 2014 the prevalence of compulsive buying in Spain was 7.1%.

It is estimated that on average it takes a compulsive buyer 10 years to seek professional help.

Compulsive buying is not an isolated condition, on the contrary, it has a broad relationship with other mental conditions such as affective disorders (anxiety, depression, bipolar disorder), addictions (gambling, substances, sex), eating disorders (8-35%), and problems with impulse control (for example ADHD).

How do I know if I have a Compulsive Buying Problem?

The following are some signs that you have a compulsive buying problem:

- Buying frequently and without control, despite not needing the products or not being able to pay for them

- Feeling an irresistible desire to buy accompanied by strong anxiety or excitement before, during, and after buying.

- Spending more than you can afford, overdrawing your credit cards, and borrowing money to continue shopping.

- Delay in paying your bills or basic obligations at home due to the money you spend on purchases.

- Deceiving your partner, family, or friends about your behavior and finances. Lying to justify your purchases.

- Feeling guilt, shame, regret, or depression because of your purchases.

- Your work, family, or social life is being affected by your purchases.

- Trying unsuccessfully to reduce or stop shopping.

If the above sounds like your current reality you need to seek professional help. A psychologist or psychiatrist will conduct a complete clinical evaluation of your case to determine the treatment options that best suit you.

Photo by ???????? Janko Ferlič on Unsplash

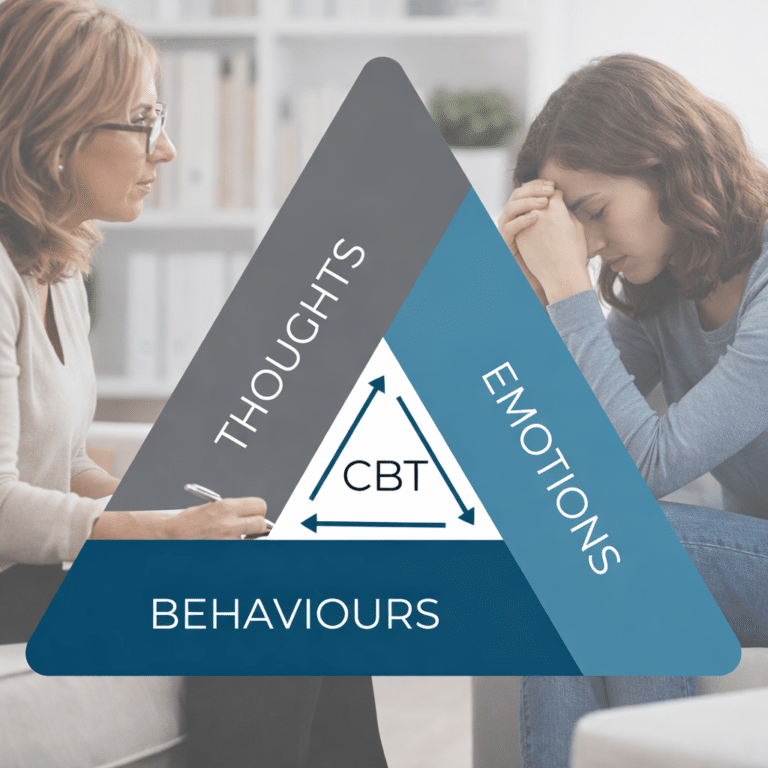

The treatment of compulsive buying may include medication, cognitive behavioral psychotherapy, group therapy, or family therapy depending on the underlying diagnosis that may have led to the compulsive buying.

How to Improve your Financial Health Starting Today:

Here are some practical tips that you can apply to start improving your financial health today:

- Make a monthly budget. Write down your monthly income and subtract the basic obligations that you cannot fail to meet (utilities, education expenses, food, medications, and transportation/gasoline). This way you will really know how much money you have for extra purchases.

- Keep a record of the products and services you pay for, where, when, how, and why you purchase them. This way, you create awareness of the situations and emotions that may be triggering your compulsive purchases. This will be a starting point when going to therapy.

Photo by youssef naddam on Unsplash

3. Whenever you truly need to do some shopping, keep a list of what you need and make sure you stick to the budget. Commit not to buy anything that is not on the list. The purpose is to return home without additional debt.

4. Direct your energy toward other activities such as exercising, volunteering, pursuing a hobby, or meditating. Over time these activities will become healthy ways to deal with your emotional needs.

5. Implementing the previous points can be difficult when you have a problem, lean on your family and friends, and talk about your problem and your will to change, it will make the path lighter.

Compulsive shopping is a mental health and financial problem for which, fortunately, there are treatment options. Seeking professional help will lead you to live a full life, maintain good relationships with your loved ones, and achieve financial security.

Edited by: Maddison Henley, PA-C

Other Blog Posts in

Animo Sano Psychiatry is open for patients in North Carolina, Georgia and Tennessee. If you’d like to schedule an appointment, please contact us.

Get Access to Behavioral Health Care

Let’s take your first step towards. Press the button to get started. We’ll be back to you as soon as possible.ecovery, together.